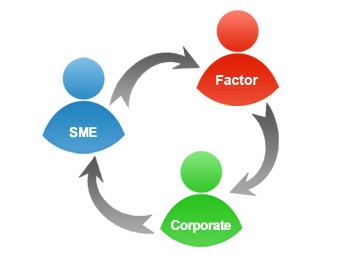

Connecting SME’s and Factors

We offer the most simple and practical approach for Factors to mitigate risk and scale their program to fund SME’s receivables and payables.

Why Vayana

- Factors can scale and enhance their factoring program with simultaneous increased tracking of invoices and reduction of follow up with debtors

- SME's can provide Factors with debtor feedback on invoices and thereby expedite factoring

- Debtors can reduce follow up from factors on invoice status. They also receive electronic invoice data to integrate transactions to their accounting systems.

There are just 3 simple steps to be part of the Vayana Network:

Qualify

We market the program to SME Clients along with the Factor. We review the invoicing process and understand the current invoice formats

We market the program to SME Clients along with the Factor. We review the invoicing process and understand the current invoice formats

Get Onboard

We integrate to the financial and accounting systems of the Client ensuring minimal change to existing commercial processes. The Factor and Debtor receive electronic commercial documents along with data.

We integrate to the financial and accounting systems of the Client ensuring minimal change to existing commercial processes. The Factor and Debtor receive electronic commercial documents along with data.

Transact

We closely work with the Client and Debtor and ensure smooth flow of commercial documents and their acceptances. We provide daily reconciliation and settlement information to all parties. The Factor can focus on credit process and increasing their Client base without worrying about operations or infrastructure.

We closely work with the Client and Debtor and ensure smooth flow of commercial documents and their acceptances. We provide daily reconciliation and settlement information to all parties. The Factor can focus on credit process and increasing their Client base without worrying about operations or infrastructure.

For a Client, we usually take no more than couple of days to start the program.